- Technische Daten/Service Level

- Verfügbarkeit: 99,9 %

- Support und laufende Softwareaktualisierungen für Logisth.AI-Komponenten

- Unterstützte Formate für Beleguploads: TIFF/PDF/JPEG/PNG

- Keine Datenspeicherung – Live-Buchhaltung

- Verarbeitungsgeschwindigkeit: ~5000 Belege pro Stunde

- Automatischer Import in die Buchhaltung.

- Betrieb in ISO-zertifizierten Rechenzentren in der EU

- Die Software ist DSGVO-konform

Logisth.AI Leistungsbeschreibung

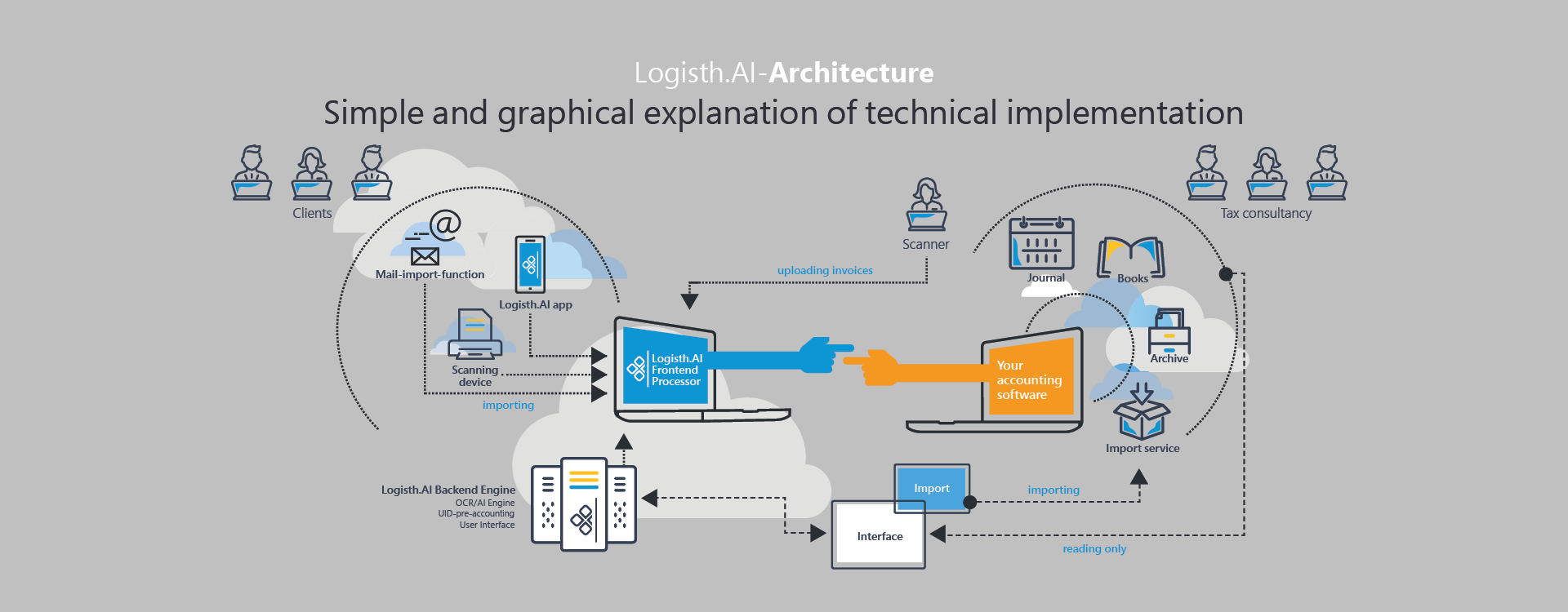

Übermittlung von Belegen/Dokumenten

- Einfache Weitergabe von Belegen/Dokumenten an den Steuerberater per:

- Mail-Import

- Logisth.AI App

- Web-Upload

- Dokumentenportal zum Hochladen von Rechnungen/Dokumenten mit Mini-Freigabeprozess.

- Übermittlung von Belegen/Dokumenten vom oder an den Steuerberater

Receipt editing

- automatische Erkennung und Buchung von beliebigen Rechnungen

- automatische Belegtrennung

- Hohe Belegausleserate mit Erkennung von:

- Belegnummer, Belegdatum, Belegkonditionen

- Kunden- und Lieferanten

- Validierung von erkannten UID-Nummern und IBAN

- verschiedenen MwSt.-Sätzen zur Erzeugung von Split-Buchungen

- Gutschriften

- Sofortige Ergebnisverfügbarkeit mit visueller Markierung bereits beim Upload, mit der Möglichkeit zur Korrektur.

- Selbstlernender Vorschlag zur Kontierung, insbesondere bei Kassenbelegen

- Automatische Übertragung in das Buchhaltungsprogramm.

- Möglichkeit, eine Rechnungs- oder Lieferantenzahlungssperre zu definieren

- Unterstützung für Kostenstellen, Kostenschlüssel und verschiedene Währungen

Offene Posten & Zahlungen

- Überblick über Offene-Posten-Liste (Debitoren/Kreditoren)

- Zahlungstool für Klienten zur eigenständigen Überweisung

- Übersicht über überfällige Rechnungen

- Bearbeiten von Lieferantendaten wie (IBAN, BIC, Konditionen)

- Möglichkeit zur Bezahlung von Rechnungen aus der Vorerfassung

- Zahlung offener Rechnungen durch SEPA-Transaktionsdatei

Dokumentenaustausch mit dem Steuerberater

Übermittlung von Dokumenten vom oder an den Steuerberater

Reduzierung des E-Mail-Verkehrs

Receipt search

- Volltextsuche für Rechnungen bearbeitet durch Logisth.AI

- Ansicht/Download einer Rechnung zugeordnete Belege

- noch nicht verbuchte Rechnungen anzeigen (Vorerfassung)

Zweistufiger Rechnungsworkflow

- Nach dem Hochladen einer oder mehrere Rechnungen müssen diese von verschiedenen Usern (Rollen) freigegeben werden

- Kunde kann Steuerberater mitteilen, dass alle Rechnungen für das Monat fertiggestellt sind

- Steuerberater kann freigegebene Rechnungen verarbeiten

Dashboard

- Sofortige Einblicke in Unternehmensergebnisse

- noch nicht verbuchte Belege werden berücksichtigt (Live-Buchhaltung)

- Finanzdiagramme und Kennzahlen wie Liquidität, Eigen- und Fremdkapitalquote und Umsatzrendite.

- Anzeige der Zahlen der letzten 4 Jahre

- Kontenstand (nur für finAPI-Anwender)

Analyse

- Alle erforderlichen Aufstellungen und Auswertungen für die Buchhaltung Saldenliste

- Gewinn- und Verlustrechnung

- Kontenblatt

- Bilanz*

- Anlagevermögen*

* nur für BMD-Anwender

CSV-File Download von Ergebnissen

Herunterladen von CSV-Dateien aus:

- Accounts ledger

- G&V

- Bilanz (nur für BMD-Anwender)

- Kontoblatt

- Planung

- Debitoren

- Kreditoren

- Stammdaten

Zahlen mit finAPI

- Kunden können direkt Rechnungen von Ihrem Bankkonto bezahlen

- aktueller Kontostand

- Für den Steuerberater: Abholung aller Bank Transaktionen für die Auszifferung (Abholung der CAMT-Dateien über die Bank kann entfallen)

Mehrstufiger Workflow

- zur Dokumentation und Automatisierung von Rechnungen

- Definition von beliebig vielen Freigeber

- Ergänzung von Informationen wie z.B. Kostenstelle, Gegenkonto, etc.

- Beispiel für den Prozess:

- Eine Sekretärin lädt die Rechnung hoch und weist sie dem Projektleiter zu.

- Der Projektleiter gibt die Rechnung frei (Stufe 1) und weist diese zur zweiten Freigabe durch den an den Geschäftsführer zu.

- Der Geschäftsführer gibt die Rechnung frei (Stufe 2) und importiert sie in das Buchhaltungssystem.

Planung

- Planung von monatswerten je Konto mit Anzeige von Betriebsergebnis, Gewinn, etc.

- Ist-Werte aus der Vergangenheit können als Ausgangspunkt für die Zukunft verwendet werden

- In der Gewinn- & Verlust Rechnung werden die Planwerte gegenübergestellt

Kunden- & Lieferantenstammdaten

- Stammdaten-Übersicht, mit z.B. Kontaktdaten und Bankdaten, UID-Validierung und Zahlsperre.

- Pflege oder Löschen von Stammdaten im Buchungssystem

- Aktualisierung, Bearbeitung und Löschung der Daten möglich

Personalisierung

- Integration eines eigenen Logos und Farben

- Gestaltung eines gebrandeten Kundenportals

Achievement potential

Documents in 1 hour

Scan rate

Correctly identified documents

Recognition rate

Yearly time saving

Time spent

DSGVO-conformity

Data protection

Schnittstellen zu Buchungssystemen

Können Sie Ihr Buchungssystem hier nicht entdecken? Auf Anfrage sind wir gerne bereit, eine Schnittstelle herzustellen!

Your data is safe

Logisth.AI conforms to DSGVO!

The architecture was specially chosen so that Logisth.AI doesn't save personal data or receipt-related data in the cloud. The documents are transferred to Logisth.AI, the results are automatically sent back after recognition and the data is deleted.

Data necessary for recognition (e.g. data learned about the customer or supplier base) is retrieved from a server installed on customer premises for the duration of the runtime and not saved.

The operation runs as SAS (Software as a Service) in a cloud environment. The cloud runs from a European ISO-certified data processing centre in Germany.

References